Automated Trading Custom

Algorithm Development

About Us

"We create high-quality technologies and Strategy"

Fincapex is always better than manual trading. Fincapex is fully automatic trading without any manual intervention. It is a emotionless trading which is very important thing while trading because most of the time we loose money due to emotions. Our web-based Fincapex terminal works with the leading brokers of India who those are providing facilities of API based trading. It is very simple system which gives your relief from watching charts all the time and it saves much time to do other tasks. Fincapex is India’s First Auto robot trading terminal which is based on a web-browser. It is preloaded with the best Fincapex Such as Money Machine and Eagle trading system.

Right Product,Right Place, Right Time,

For those who have a solid grasp of trading fundamentals and are ready to take their skills to the next level, fincapex provides advanced resources and strategies

24/7 Support Team

Our Support Team Always Ready

To Help You.

Quality Services

Fully Automated Mechanical Functionally.

Budget Friendly

Trades executed at the best possible price.

WHY CHOOSE US

Our Special Features

AUTOMATED FUNCTIONING

Automated Buy And Sell Signal With Target.

MARKETS AND INSTRUMENTS

Best indicators for market analysis.

STRATEGY DEVELOPMENT

We develop your strategy with our code

Our Ratios

We Always Try To Understand Customers Expectation

OUR SERVICES...

We deliver what you think and dream of.

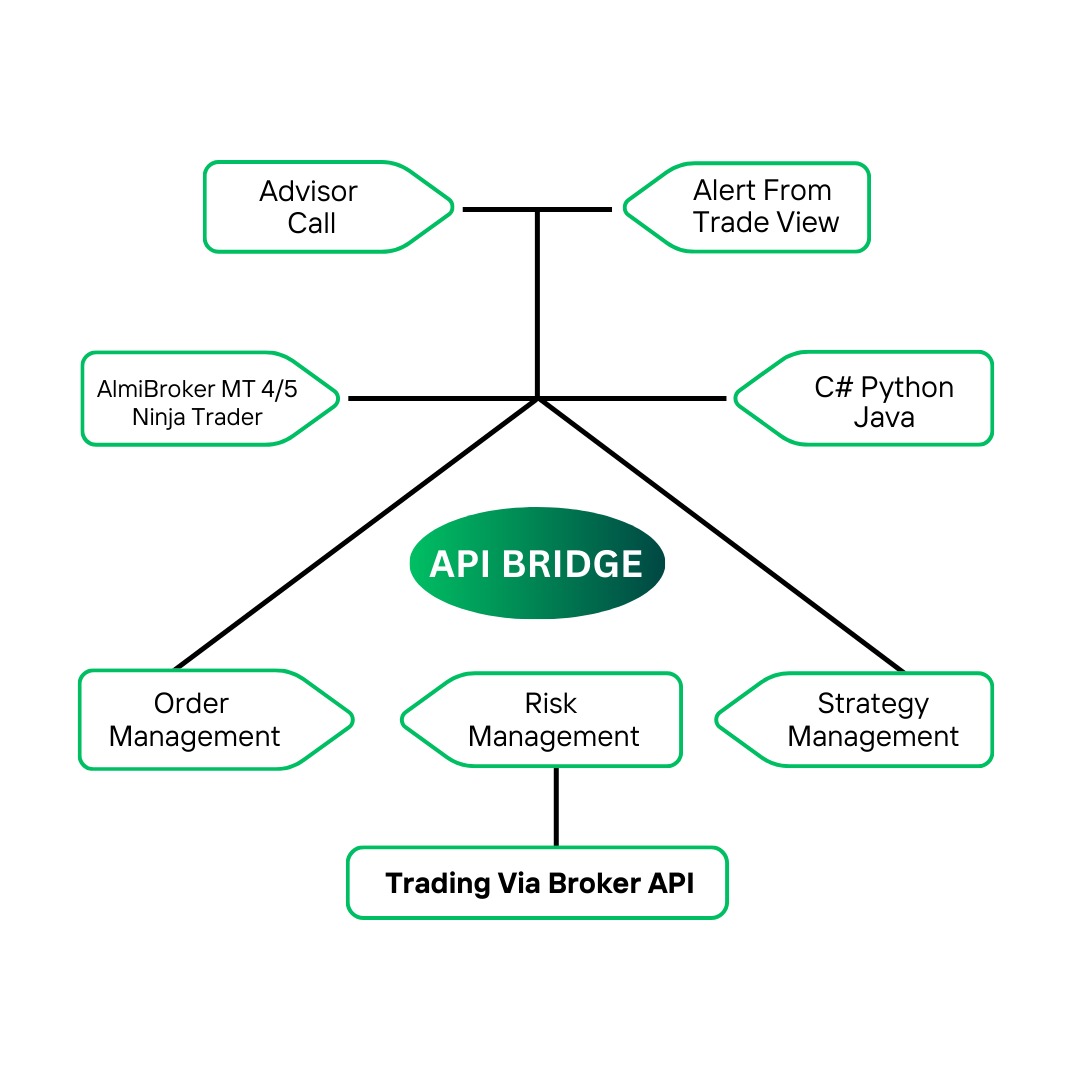

ALGO TRADING

Algo Trading is a form of automaed trading in which market data is analyzed by PC programs based on pre-defined parameters.

DIGITAL MARKETING

Search Engine Optimization Millions of searches are happening every second on the internet. Get your business found online, when users search for your products or services. Keyword optimization in your website + off-page SEO to e

Web Development

We have a dedicated team of experienced and knowledgeable web developers, designers and testers. Therefore, we have mastery and proficiency in analyzing, developing and designing the necessity of intricate Website Development pro

Graphic & Video Design

Competently recaptiualize team building ROI without competitive quality vectors. Rapidiously predominate flexible channels with progressive catalysts for change. Holisticly target intuitive functionalities vis-a-vis future-proof

Mobile App Development

Fincapex gives you the chance to commission your own apps so, you can meet the exclusive needs of your customer, better than anyone else on the market. We use our knowledge and skills to build apps which are equiv

Content Writing Services

We all know that content is the king of every online business. To generate the traffic on your products and services it is significant to hire the professional content writing services who is expert in

What type of challenge are you facing? Let’s talk

Frequently Asked Question

We want to make your experience on our platform as smooth as possible, here are some frequently asked questions, if these dont solve your doubts, feel free to contact us.

What is Algo Trading

Algo Trading, short for algorithmic trading, refers to the use of computer algorithms to execute trading orders in financial markets.

Algo trading involves creating and implementing pre-defined sets of rules and instructions that automate the trading process, eliminating the need for manual intervention.

What is Algorithmic Trading

Algorithmic trading, also known as algo trading, is a method of executing trades using automated computer programs.

These programs analyze market data, execute trades, and manage risk based on predetermined algorithms.

Algorithmic trading aims to increase efficiency and reduce human errors associated with manual trading.

To engage in algo trading, follow these general steps:

Develop a trading strategy or idea, Convert the strategy into a set of rules and conditions.

Implement those rules into a tradetron algo trading platform.

Test the algorithm using historical data. Deploy the algorithm to execute trades automatically or generate trade signals.

How does Algo Trading work ?

Algo trading works on engines that receive and process market data in real-time.

These programs use mathematical models, technical indicators, and historical data to identify trading opportunities.

Once a predefined condition is met, such as a specific price level or trend pattern, the algorithm automatically starts its work by generating and executing trade orders.

Is Algo Trading Profitable ?

Algo trading can be profitable, but it depends on various factors such as the effectiveness of the trading strategy, market conditions, risk management, and the quality of the algorithm's implementation.

While algo trading has the potential to generate profits by executing trades at high speed and with precision, it also carries risks, and profitable algo trading requires continuous monitoring and adaptation.

What is squqre off in trading ?

Square off in trading refers to the action of closing an existing position in a financial instrument, effectively exiting the trade.

In trading, square off is commonly used to describe the process of selling a purchased asset or buying back a short-sold asset. It allows traders to lock in profits or cut losses by completing the transaction and eliminating their exposure to the market.

What risks are unique to automated trading ?

Mechanical failures. The theory behind automated trading makes it seem simple: Set up the software, program the rules and watch it trade. In reality, however, automated trading is a sophisticated method of trading, yet not infallible. There is also the potential for a power loss, computer crash, or some other system quirk that could stop your algorithm from running or cause an anomaly.

Monitoring. Although it would be great to turn on the computer and leave for the day / week, automated trading systems do require monitoring or an alerting system. This is due to the potential for mechanical failures, such as connectivity issues, power losses or computer crashes, and to system quirks as mentioned above. It is also possible for an automated trading system to experience anomalies that could result in errant orders, missing orders, or duplicate orders. If the system is monitored and/or has an alerting system, these events can be identified and resolved quickly.

Trading Experience. Your level of trading experience with automated trading systems is important in deciding how you should choose your overall trading strategy. Highly complex strategies with many variables make it more difficult to determine whether the trades that will execute are designed to be profitable. Starting with simple automation strategies will allow you to develop experience and learn methods of trading that work best for you.

Over-optimization. Though not specific to automated trading systems, traders who employ backtesting techniques can create systems that look great on paper and perform terribly in a live market. Over-optimization refers to excessive curve-fitting that produces a trading plan that is unreliable in live trading. It is possible, for example, to tweak a strategy to achieve exceptional results on the historical data on which it was tested. Traders sometimes incorrectly assume that a trading plan should have close to 100% profitable trades or should never experience a drawdown to be a viable plan. As such, parameters can be adjusted to create a "near perfect" plan – that completely fails as soon as it is applied to a live market.

Programming discrepancies. There could be a discrepancy between the "theoretical trades" generated by the strategy and the order entry platform component that turns them into real trades. Most traders should expect a learning curve when developing automated trading systems, and it is generally a good idea to start with small trade sizes or conduct “paper trading” while the process is being refined.

Reliance on Risk-Reducing Orders or Strategies. With automated trading, substituting manual market monitoring with the placing of certain orders (e.g. ‘stop-loss’ orders or ‘stop-limit’ orders) which are intended to limit losses to certain amounts may not be effective because market conditions may make it impossible to execute such orders. At times, it is also difficult or impossible to liquidate a position without incurring substantial losses

How does trailing stop loss work ?

There are 3 settings you can use to setup the Trailing Stop loss feature on your strategy.

Activate at allows you to set the absolute amount of money the strategy should be in profit for the TSL to get activated. At this level the TSL will set to 0 which means if the profit falls back to 0, the strategy will exit and you will not end up making no profit no loss.

As the profit increases and goes in favour of your strategy, you want to trail the stop loss so that you dont give away all the notional profit the strategy had made. For which you use the other 2 settings .. You can set it up to increase the TSL by xxx amount when the profit increases by yyy … So lets say you activate the TSL at 3000 profit and then choose to increase it by 1000 with every 1000 increase in profit. So when the profit touches 4000, the TSL will be at 1000 and at 5000 profit it will be at 2000 ; now if the profit drops to 2000, the strategy will exit for all positions.

TSL can only be setup at at strategy level and not at a set level. If you wish to set it up at a set level, you have to use your own keywords and conditions to make that happen.

How does price execution work ?

There are 5 fields you can use to setup the price execution logic

1) Initiation price

2) Revision attempts

3) Increase by tick

4) Timeout and

5) Final Action

Initiation price options are a) Avg of Bid and Ask b) Best Price 3) Market Price 4) LTP ….

If Avg of Bid and Ask price is chosen, for each leg and each tranch the trading engine will fetch the ask and bid price in real time, calculate the avg of both and submit a limit order at that price ; Best price, for all buy orders the best bid price will be used as the limit price and for sell orders the best ask price will be used ;

for Market price, Order will be placed with price 0 to get the order filled as market order ;

for LTP, the LTP will be used as Limit price.

0 price will not be submitted as the order price in final action ("execute at Market price") if initiation price is LTP, avg of bid-ask or best price due to the various inherent risks involved in such a strategy.

Once the initial price has been submitted, now the engine will look at revising the price with the goal of getting the order filled.

You can set this no of attempts in the 2nd setting.

During each revision, the price should get closer to getting filled by how many ticks can be mentioned in the 3rd setting .

Between each revision how much time should elapse for a timeout can be mentioned in the 4th setting and finally if after all revisions, the order is not filled what should be the final action - should the order be filled at market price or be cancelled can be setup in the 5th setting. If final action is selected as market, a limit order will be placed with a price 5% above initiation price in case of buy order and 5% below initiation price in case of sell order

What are the benefits of Algorithmic Trading?

Speed: Algo-trading systems can process and execute orders in fractions of a second.

Accuracy: The algorithms can analyze large amounts of data and execute trades without human error.

Cost-Efficiency: It reduces the need for human intervention and minimizes transaction costs.

Backtesting: Algorithms can be tested using historical data to optimize strategies before using them in real markets.

Market Liquidity: By continuously executing orders, algo-trading can contribute to more liquid markets.

What tools and technologies are used in Algorithmic Trading?

Programming Languages: Python, C++, Java, and R are popular languages used for developing trading algorithms.

Trading Platforms and APIs: Many traders use platforms like MetaTrader, Interactive Brokers, or QuantConnect, which provide APIs to interact with financial markets.

Data Feeds: Real-time and historical market data are crucial for algorithm development and testing.

Backtesting Software: Tools like QuantConnect, Backtrader, and MetaTrader enable traders to test their strategies on historical data.

Machine Learning: Increasingly, machine learning and AI are being incorporated into algorithmic trading strategies to predict market trends based on large datasets.

Who uses Algorithmic Trading?

Institutional Traders: Large financial institutions such as hedge funds, asset managers, and banks use algorithmic trading to handle large volumes of trades.

Retail Traders: Individual traders can also use algorithms, although they might be at a disadvantage in terms of speed and access to resources.

Market Makers: Entities that provide liquidity by quoting buy and sell prices often rely on algo-trading systems.

Do I need to know how to code to use Algorithmic Trading?

While coding is not strictly necessary, knowledge of programming is extremely beneficial if you want to develop custom trading algorithms. There are also platforms and brokers that provide pre-built strategies or offer drag-and-drop tools, making it easier for non-programmers to create and execute algorithmic strategies.

How do I manage risk in Algorithmic Trading?

Stop-Losses: Implementing automatic stop-loss rules can help limit downside risk.

Position Sizing: Limit the size of each trade to prevent large losses on any single position.

Diversification: Spread risk across multiple strategies or asset classes.

Monitoring and Alerts: Even though algorithms can run autonomously, it's crucial to monitor them and set up alerts for abnormal behavior.

Call Us Today For Book Free Demo .

Our Testimonials

What Our Clients Say’s

Mr. Shubham Singh

Fincapex has been a game-changer for my trading strategies. The comprehensive documentation and easy-to-use interface make it accessible even for beginners. I particularly appreciate the real-time data analysis features."

Mr. Vikram Jat

Fincapex provides an impressive range of features that cater to both novice and experienced traders. The real-time analytics and the ability to backtest strategies have been particularly beneficial. I’ve had a positive experience and would recommend it to others."

Mr. Mohit jain

"I was initially skeptical about using a new platform, but Fincapex exceeded my expectations. The customer support is excellent, and the platform’s performance is top-notch. I have seen a significant improvement in my trading results since I started using it.

Mr. Anshuman Desai

"As a professional trader, I rely heavily on Fincapex for its accuracy and efficiency. The customizability of the algorithms allows me to tailor my strategies perfectly. The platform is robust and reliable, making it an essential tool in my trading arsenal."

Mr. Tarun Prajapat

"I have been using Fincapex for the past six months, and it has completely transformed the way I approach algorithmic trading. The platform is user-friendly, and the support team is always ready to help with any queries. Highly recommended!

Mr. Vivek Gupta

"Fincapex platform offers a seamless experience with powerful tools that are easy to navigate. The tutorials and resources available have been incredibly helpful in understanding complex concepts. It’s a must-have for anyone serious about algorithmic trading."

We are a diversified company specialized in providing comprehensive financial solutions for individuals and businesses.

Important links

Contact us

-

104 SCHEME NO-54,

MR -10 ROAD INDORE - +91-89669 97475

- info@fincapex.com